Greetings Readers

Well, it seems I am not the only unreconstructed Luddite around. I try to push you into 21st century technology and you pull me right back!

Some of you have told me you want some writing! That is to say you want the script for the January podcast. It's a bit unpolished, but here it is.

I am just joking. The plan was always actually to give you a written and podcast version in future, however I want to get the written version in a format where it is just headlines and you can click on the stories that interest you for full details. I am not there yet so below is the usual long ting!!

In this issue:

1. Navig8or Newsletter Reader Satisfaction Survey Results

2. US Interest Rates up 0.25%...more of a nudge than a hike

3. Is China ready to face up to its problems?

4. New e-learning platform coming soon...and request for testimonials

1. Navig8or Newsletter Reader Satisfaction Survey Results

Firstly, thank you to everyone who took part in this survey. Your opinions and feedback are useful and valued.

43 people completed all or part of the survey and I have detailed will give you the key headlines below:

- Over three quarters of respondents had been receiving the newsletter for at least 2 years

- Just under 40% of respondents were female and just over 60% male

- Over three quarters of respondents live in Europe which is a higher proportion compared to the overall composition of the subscribers to the newsletter.

- 95% of respondents rated the quality of the newsletter as Good or Better, with just over 51% rating it as Excellent and 5% rating it as Satisfactory.

- When asked 'Which of the following words or phrases would you use to describe our newsletter?', out of ten choices the three most frequently chosen were Informative (84.62%), High Quality (58.97%) and Useful (46.15%). 10% of respondents indicated that the newletter was 'Too long' which was not a total surprise to me!!

- When asked about which topics they would like to see covered in the newsletter based upon their experience as a reader the three most popular choices (out of 8 choices) were: Economic Trends and Analysis (82.05%), Politics (74.36%) and History (43.59%). The least chosen options were Health & Law/Criminal Justice System with 20.51% each.

- Respondents were asked 'What do you most value about the newsletter'. I won't detail all of the responses, but here are the first dozen:

Focused on culture and relationship with econimics and politics

information that can be used straightaway practically and also signposts to other sources

The wake up African people call message !

The linking of economics, history and attitudes of Afrikans

The way the facts on the informtion are presented; and your opinions on said information.

Information, insight and instigating debates

Very direct and deals with relevant issues affecting the black community.It has given me a lot of motivation in trying to work with others to build an entity that belongs to 'US'.

It's Afrikan-centeredness

Consitantly high standard. Well researched

sharp, deep, Afrikan-centered global economic geopolitical analysis

Respondents were asked 'How can the newsletter be improved' and the first dozen answers are set out below:

More links and sources to education, business and culture and how this relates to entrepreneurship in UK and in various Afrikan communities around the World

perhaps breaking up long passages of text with more graphics/images

Maybe have section where you publish the audience comments on subjects covered in your newsletter. Also you may wish to have a question and answer section where the audience submit a question on a subject covered in your newsletter and you respond to it?

getting a better sense of what the author is up to

CONTINUE TO REMAIN AWARE AND AHEAD OF TRENDS

Reducing text, increasing header and sections with possible read more links for those interested in pursuing specific topics more extensively

I have thouroughly emjoyed it as it is and please dont make it short. Just keep the good work going.

Make it more practical with follow ups to ensure readers go beyond reading and actually applying the knowledge newly acquired

It is a little long at times.

- Over 76% of respondents indicated they would like to see guest contributors

- Under any other comments respondents said:

Excellent Newsletter from very experienced professional and knowladgeble writer in Paul Ifaymi Grant who always invites people to challenge his commentary by conducting their own research - I greatly admire his knowledge, opinions and writing style.

Thank you so much for your resilience and the time you spend in putting this information together and trying to keep us in the know it's very much appreciated

kEEP UP THE WONDERFUL WORKS

Your dedication to your belieifs is uplifting and reassuring!

Excellent work. Worth every effort! Keep it up!

Thank you for the good work.

To get the newsletter become an Afrikan-centered university where our warriors for liberation are trained to overthrow our enemies

There is a tremendous need for Afrikan understanding of the significance of political economy in relationship to the development of the Afrikan World Nation. We need to find ways of meeting face to face, and planning.

Once again thank you to all of you who responded. Even if some of your comments have has not been reproduced above, for the sake of space, I have read them all.

2. US Interest Rates up 0.25%...more of a nudge than a hike

Well, as I indicated in the December newsletter, the US Federal Reserve did indeed raise its base interest rate by 0.25%. Not so much a hike as a nudge. Given that they have been talking about raising the base rate for the whole of 2015 Janet Yellen, Chair of the Fed, had pretty much backed herself into a credibility corner, given that she has also been talking up the US economy all year and the only basis for reneging on the promised rise in interest rates would have been gloomy economic news. Now of course there is plenty of gloomy economic data in the real world (commodity prices such as copper and iron, oil prices, Baltic Dry Goods index) which indicates a significant downturn in global economic demand, however the Federal Reserve and corporate media aren’t interested in such matters.

One predictable impact of the rise in interest rates has been a strengthening of the dollar against other currencies. Below is a snapshot of how the pound has weakened against the dollar falling from over 1.51 dollars to the pound to just over 1.44 dollars to the pound between 12/12/2015 to 11/01/2016.

It will be interesting to see how long it takes for the UK, EU and Japanese central banks to follow suit. One thing that is certain, because of all of the real world negative economic data all of them are going to proceed very cautiously in increasing interest rates and I would expect to see perhaps two more quarter point rises at most in the US during 2016.

Meanwhile over in the UK, the Governor of the Bank of England, Mark Carney, has stated that UK interest rates are unlikely to rise in the near future due to concerns over the global economy. So the signs of a global recession which could become a depression are everywhere.

What are Implications for Afrika? Well, this is bad news for Afrikan countries and most of their populations. The higher US interest rates rise during a global recession the worse it will be for Afrika. The reason? The dollar is the currency of international trade, the world’s reserve currency. In a time of a strong global economy what Afrikan countries lose in terms of the pricing of their commodities in dollars, they would make up for to some degree by the growth in the volume of commodities sold. However in a global recession (with rising US interest rates), which is what we are in, there is the perfect storm of a strengthening dollar and declining demand for commodities which means a drastic fall in export income and hence a decline in GDP, since most Afrikan countries are almost entirely dependent on a few commodities to bring in the majority of their foreign exchange, which they use to pay their large debts and contributing to the financing of their domestic public services!

The following article brings the foregoing into stark relief, highlighting how the price of copper - usually seen as an economic bellweather - has fallen to a six year low largely due to falling demand from China which consumes about 45% of world production. As the article notes:

“The psychology is that global GDP is slowing down … and China in particular there’s a great doubt,” Mr. O’Neill said. Investment “funds are treating industrial commodities like a plague.”

The article goes on to note that “Aluminum was down 2.3 % at $1,460 a ton, while zinc fell 1.7 % at $1,482 a ton. Nickel was down 3.3% at $8,269 a ton. Even precious metals like palladium and platinum that are used in industrial processes fell, both down nearly 4% for the day.”

http://www.wsj.com/articles/coppers-falls-to-new-six-year-low-on-concerns-over-china-1452514466 By TIMOTHY PUKO, Updated Jan. 11, 2016 3:19 p.m. ET

I have been telling you all consistently that if you are confused or suspicious over economic data then go back to basics and examine data that is hard to fake. Unemployment data is easy to fudge, alter and change. The same for inflation. However the long-term fall in commodity prices and measures such as the Baltic Dry Goods Index give you much more reliable measures of aggregate demand in the global economy. Of course I have told you about the rigging of the gold price in the Comex market, but if you look at demand for real gold (as opposed to the rigged gold futures market which is what the Comex market is based upon) you see it is very strong which tells you that countries and people are looking for a safe haven for their money. When demand for gold is strong the global economy is normally weakening.

What are Implications for you? - In the short-term the US interest rate rise and signal that US interest rates are likely to rise very slowly over the next few years is unlikely to have a huge impact on your personal finances. Interest rates are still too low to be of much assistance to pension funds and so companies are still going to be faced with the prospect of having to make substantial annual contributions to top up their pension funds.

The global recession which commenced in 2007 is not at an end and never really ended despite the economic fairytales the corporate media has peddled, particularly since around 2010 when they started to push talk of ‘economic greenshoots’ and a recovery.

It is important to understand that there are two parallel economic worlds operating side by side, refuting the notion that two entities cannot occupy the same space and time. There is the world of corporations and the super rich ( (Dimitri Orlov chart) i.e. those with a net worth of around €500M and above); and then the world of the vast majority of the population, and particularly the bottom 90%. In the former world of corporations there is an almost unlimited supply of virtually interest free credit, production can be moved to the cheapest skilled location in the world, workers’ benefits in the rich world can be cut; and zero hours, part-time and temporary contracts used to keep them scared and compliant and the company share price inflated through mergers and acquisitions and share buy backs, leading to huge executive bonuses and/or pay increases. In this world Executive A sits on Executive B’s renumeration committee and Executive B sits on Executive C’s renumeration committee; and Executive C sits on Executive A’s renumeration committee. And they all live happily ever after. Meanwhile the super rich, which includes the very richest of these corporate titans, also have access to super cheap borrowing to buy up assets on the cheap and they also have access to various hedging mechanisms which ensure that they operate in a virtually risk free financial world. These people are the primary beneficiaries of super low interest rates. Whatever benefits trickle down to the 90% is purely by accident and not design. It’s like the saliva running down the chin of a glutton who cannot have their appetite sated.

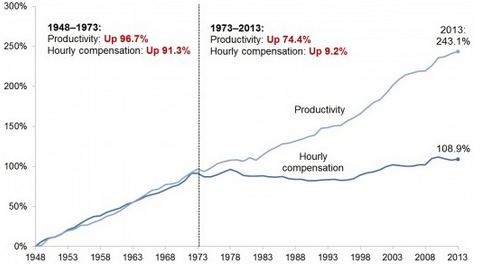

In our world (apologies if you are reading this and are worth more than €500M. I do have a wide readership!) there has been a systematic undermining of the wages of the vast majority of the population and a concerted effort to push the nonsensical idea that wage rises are bad for the economy. The chart below, which i think i have shared before in a previous newsletter, demonstrates how the link between productivity and hourly compensation was comprehensively broken, starting in around 1973. Many economic commentators, including me, do not think it is a coincidence that this divergence followed close on the heels of the the United States coming off the gold standard which was initiated on 15 August, 1971 when President Nixon announced that the U.S. dollar would no longer be convertible into gold in the international markets. Nixon was able to suspend the ability to convert the dollar into gold because there was no legal requirement that the United States exchange gold for dollars. On 18 December 1971 the President devalued the dollar, and even though the devaluation was effective immediately, only Congress could officially change the gold value of the dollar. Early in 1972, Congress passed Public Law 92- 268, which gave formal approval to the December 1971 devaluation and the rest is history as they say.

http://www.theatlantic.com/business/archive/2015/02/why-the-gap-between-worker-pay-and-productivity-is-so-problematic/385931/

Five Stages of Collapse (Dimitri Orlov)

The day of reckoning for a century of putting our faith in the wrong people with wrong ideas and evil intentions is upon us. Dmitry Orlov provides a blueprint for the collapse in his book – The Five Stages of Collapse – Survivors’ Toolkit:

Stage 1: Financial Collapse. Faith in “business as usual” is lost. The future is no longer assumed to resemble the past in any way that allows risk to be assessed and financial assets to be guaranteed. Financial institutions become insolvent; savings wiped out and access to capital is lost.

Stage 2: Commercial Collapse. Faith that “the market shall provide” is lost. Money is devalued and/or becomes scarce, commodities are hoarded, import and retail chains break down and widespread shortages of survival necessities become the norm.

Stage 3: Political Collapse. Faith that “the government will take care of you” is lost. As official attempts to mitigate widespread loss of access to commercial sources of survival necessities fail to make a difference, the political establishment loses legitimacy and relevance.

Stage 4: Social Collapse. Faith that “your people will take care of you” is lost, as social institutions, be they charities or other groups that rush to fill the power vacuum, run out of resources or fail through internal conflict.

Stage 5: Cultural Collapse. Faith in the goodness of humanity is lost. People lose their capacity for “kindness, generosity, consideration, affection, honesty, hospitality, compassion, charity.” Families disband and compete as individuals for scarce resources. The new motto becomes “May you die today so that I can die tomorrow.”

http://www.marketoracle.co.uk/Article42204.html

3. Is China ready to face up to its problems?

The above piece on the fall in commodity prices, linked to the global slowdown and sharply falling Chinese demand is a neat segway into discussing the turbulence we have seen in the Chinese stock market.

A Bloomberg article noted that “China moved to support its sinking stock market as state-controlled funds bought equities and the securities regulator signaled a selling ban on major investors will remain beyond this week’s expiration date, according to people familiar with the matter.”

http://www.bloomberg.com/news/articles/2016-01-05/china-said-to-intervene-in-stock-market-after-590-billion-rout

What does this mean? Well, the Chinese government has unfortunately followed the recent ‘Western’ economic model and created a huge asset price bubble. People often talk about the trillions of US government debt held by the Chinese, but what too many commentators forget is that approximately $7 trillion in reserves held by the Chinese government is dwarfed by the around $28 trillion of Chinese government debt. With global demand for its manufactured products at a deeply worrying low, the Chinese government can’t fake the funk for too much longer. Over the past few years they have been trying to develop their domestic consumer market to make them less reliant on exports, however this is something that takes time, and given the sensible Chinese penchant for saving, cultural change. The earlier mentioned Chinese government’s decision to ban the selling of stocks by major investors is a sign of the deep turbulence in the Chinese stock market. This had global ramifications as “U.S. stocks staged an afternoon comeback on 05/01/16 in a bid to rebound from their worst start to a year since 2001 after China intervened to stabilize its financial markets. The euro slumped to its lowest point in a month and American oil slid below $36 a barrel.”

http://www.bloomberg.com/news/articles/2016-01-04/asian-futures-signal-more-muted-losses-after-u-s-pares-selloff

Basically the Chinese government had to halt share trading twice in the week commencing 4th January 2016 in order to put a stop to the mayhem, with the overall share price index falling as much as 7% in a single day.

All in all it is much more difficult for China to cover up its economic turmoil than it is for the US which can still hide behind the economic shield of the dollar’s status as global reserve currency. This could be the year when the stuff hits the fan for the Chinese economy, which could signal even greater domestic upheaval for a population that has either had a taste of; or at least sight of the economic good life and wants more. China needs to create many millions of jobs each year for its population and the dramatic slowdown in its economic growth will lead to rapidly rising unemployment with all its attendant political dangers. We are hearing that Chinese GDP growth for 2015 will come in at 6.9%, which would be fantastic by the standards of US and Western Europe, however will be the lowest GDP growth posted by China in 25 years and has to be taken with some caution as the Chinese government, like the US, are not averse to a bit of statistical skullduggery.

What are the Implications for Afrika - The economic turmoil and downturn in China is the flipside of the strengthening of the dollar. Whereas the strengthening dollar affects the price of commodities, the dramatic downturn in demand for commodities from the world’s biggest manufacturer means the volume of commodities sold by Afrikan countries in 2016 will likely fall off a cliff. Put these things together and you have a recipe for economic stagnation, which in Afrikan terms has significant life and death implications e.g. the possibility of a reversal in the long-term fall in child mortality as health budgets come under pressure. In a future issue I am going to explain to you you why so called free market economics/globalisation will never lift Afrikan countries out poverty, given their commodity extraction based economies. However as you know I write too much; so we’ll save that for another day. Suffice to say 2016 looks grim for Afrikan countries, especially given their, generally, corrupt/inept/cowardly leadership.

4. New e-learning platform coming soon...and request for testimonials

One of the great things about feedback is that it often catalyses new initiatives or ideas which have lain dormant in one's mind for too long. One such idea was for me to deliver the courses I have run face-to-face using an online platform. I have wanted to do so for the past five years

or so, but as with many good ideas have not gotten around to it. I do have a very busy life, but I also know that if you really want to do something you can always find the time to make it happen. Anyway, I had one of those seemingly chance meetings with a brother who I have known for many years, but had not seen for a few years and we got to talking about what we had been, and were currently up to. He has an arts background and skillset and had moved into web design. He asked whether I was still travelling up and down the country running courses and workshops and I said not so much as it was very time consuming and not cost effective. We then moved on to discuss online learning platforms and that was the beginning of a new business partnership. The long and the short of it is that since December we have been collaborating to develop an online learning platform where I can deliver courses and learning programmes focused on financial literacy, community economic development and business development. I have not been as excited about a new venture since writing and publishing my first book back in 2003 (how time flies) as this initiative will allow me to reach a global network in a way that was not possible before. With 40% of my newsletter subscribers based overseas and with other swathes of people in the UK who would find it difficult to find the time to attend a face-to-face course, this makes perfect sense.

Anyway the plan is to launch in March and I wanted to give you the early heads up and ask for your assistance and tell you well in advance how we can work together for mutual benefit on this project.

Assistance - You can help me in the following ways:

1. Testimonial - As you know recommendation is the most powerful form of marketing there is. If you get a recommendation from someone you know and trust for a product or service it provides what they call social proof. I am asking that those of you who are happy to and value what I do send me a testimonial. This is important since I want to reach out to people who have never heard of me before and they will need a reason to have confidence in what I do. In terms of a testimonial if you can be specific that really helps i.e. tell people how you have engaged with my work e.g. Books, courses, newsletter etc. tell people what benefit you derived. Tell people why you would recommend what I do. If you are happy to help, just email me the testimonial. Testimonials from those of you outside the UK would be particularly appreciated.

2. Sharing - Once the platform is up and running I will be sending you the website details. I will then ask you if you would share the details with your networks as you will know many people that I don't and it will be of great assistance to me.

Mutual Benefit

Affiliate Programme - I will be running an affiliate programme linked to this platform. There will no cost to becoming an affiliate and basically it will be as simple as registering, receiving a unique link, sharing that link with your networks and for anyone who pays for a course or learning programme via your link you will receive 30% of the fee they pay. You don't have to harass anyone or do any hard sell and its a win win.

So look out out for the launch email. The courses are all going to be practically focused and grounded in real life experience as well as theory and there will be a no quibble money back guarantee if participants are not satisfied with what they have got, so that people can enrol with confidence and affiliates can promote with confidence.

Well, I hope you enjoyed the new podcast format (please tell me either way) and if you can assist me with a testimonial for my new online learning platform that would be greatly appreciated. Please note the podcast can be downloaded from the website by right clicking on the link so you can store it on your desktop, mobile devices and share it with others. By the way the link music used for the podcast was Losalamitoslatinfunklovesong by Gene Harris. You can check it out here https://www.youtube.com/watch?v=yHB-2E4K8-c I am sure Desreen and Jak were not the only ones for whom it brought back good memories!

The theme of the February newsletter is 'Desperately Seeking Acceptance'. If you did not try the podcast give it a go. You can listen while seasoning the chicken or tofu! http://houseofknowledge.org.uk/newsite/

Best Wishes

Ifayomi

'It's time to win'

ifayomi@uwclub.net

www.houseofknowledge.org.uk