|

Hello <<First Name>>,

Welcome to a new month! As you look back at the year and what you set out to do, remember the words of Mother Teresa: “If you can't feed a hundred people, then feed just one.”

| Let’s dive into the news 😊 |

|

|

Nigeria

Case Dismissed!

While most of Nigeria had moved on living their normal lives, Nigeria’s two major parties PDP and APC have been slugging it out in court, with the opposition party PDP trying to overturn the results of 2018 Presidential elections. However, 8 months after votes were cast and 5 months after President Buhari was sworn in, we can now finally say it’s all over till 2023 as the Supreme Court has dismissed the case.

What PDP was saying

That Buhari had lied under oath about his educational qualifications, that the president’s secondary school certificate was a forgery, and that results from an ‘INEC (Independent National Electoral Commission) server’ proved that the PDP candidate had won the election.

Of course, APC denied all of this

Why it matters

This decision by the supreme court is not different from the many similar cases over the years – 1979,1983,1999, 2003, 2007, 2011 – where the petitioners have never won against the person declared winner.

Should anyone even bother trying to overturn a Presidential electoral win?

Up Next: All eyes are on who would contest in 2023, for us, it’s too early and we would rather focus on Kogi and Bayelsa state elections which are slated to happen on the 16th of this month.

|

|

OMO isn't for everyone

The Federal Government has decided to allow only foreign investors to purchase OMO, in a bid to increase its foreign reserve which has been on the decline.

What are you talking about?

When you hear OMO, it’s easy to think of the detergent and that’s okay. But that’s not the only meaning of OMO. In the world of monetary policies, Open Market Operations (OMO) is a short term instrument used to control the supply of money in Nigeria.

Tell me how it works again

It’s a bill issued at any time. Whenever the CBN believes the inflation rate is high due to increased money supply it sells OMO bills at high-interest rates mopping up liquidity from the economy. On the flip side, if it believes there is a low money supply due to high-interest rates it buys back OMO bills flooding the financial markets with cash. As you’d expect these are short term bills that typically should not last more than 90 days, except that these days OMO bills are now sold with maturity as long as 365 days competing toe to toe with Treasury Bills – a short term government debt security.

Does everyone have to buy it?

While they are not compulsory, However, it’s almost certain that anytime the CBN offers OMO people buy because it’s certain the government would pay back and at the moment the interest rate is as high as 15%. Also, there are always enough people looking to sell their OMO whenever the government comes knocking.

Who are these 'people' you’re talking about?

Recent data from the CBN indicate it has total OMO bills of about N13.8trillion out of which local banks held N3.95 trillion, corporates N3.7 trillion and foreign investors N6.1 trillion.

Zoom out: The restriction placed on who can buy OMO, has led to an increase in activity in the Treasury bills market. This has brought about to lower rates on treasury bills which mean lower interest rates for individuals.

|

|

Do we need more airports?

Just like many other Nigerians, you might be used to complaining of Nigeria’s poor infrastructural development, now you have more reasons for your claims because about six state airport projects in which the government has spent a huge sum of money - running into 101 billion Naira - have remained uncompleted or not optimally functional for years.

What is happening?

Akwa-Ibom, Taraba, Bauchi, Jigawa, Ondo and Kebbi States, have spent have been struggling with their airport projects which have eaten deep into the pocket of the states and can barely generate sufficient returns. This move to build airports seems like a desperate act to build status symbols or as the case is in the north an attempt to assist Muslims on their annual holy pilgrims.

But...

These projects have done nothing to affect the state economies positively. State government source for a loan to set up airports as in the case of Delta and Akwa-Ibom but can’t boast of a good return yet. Akwa Ibom, Delta, Bauchi, Jigawa, Kebbi and Taraba states, have spent N20 billion, N37.01 billion, N7.9 billion, N15.5 billion, N17 billion, and N17 billion, respectively, on airports.

Big Picture: Despite the fact that its difficult to ascertain reasonable returns on airports, more states are jumping on this bandwagon. It should seem logical that more things should be considered before setting up a state airport because, in the end, someone has to pay the bills.

|

|

Africa

It’s quite azure in the South

Isn’t it surprising how ‘South’ Africa leads the entire continental in technological leapfrogs?

What are they doing this time?

Well, they’re going to the cloud. The South African State Information Technology Agency (SITA) has signed a Memorandum of Understanding with Microsoft to move all government-owned services information to Azure Web Services which is Microsoft’s cloud platform.

Hmm. So Microsoft now owns portions of the sky?

Errr, not exactly. Simply put, cloud technology involves making computer system resources like data storage readily available on-demand, on the Internet. The cloud is where your emails and Netflix movies live.

Alright. Does this mean anything for Africa?

A lot, really. As African countries go from developing to developed with the digital transformation, they’ll be implementing solutions like this to simplify and improve governmental processes. It goes without saying that the world’s cloud giants - Microsoft, Facebook, Google, and Amazon - would find the African market very profitable. However, this is also a market for African tech companies who can beat foreign competition if cards are played well. The future’s looking rather bright here.

P.S: Hope you now know why Microsoft’s cloud platform is named Azure.

|

|

That blew up fast

Apparently, critics of the Nobel Prize winner Abiy Ahmed now have something to ‘feel good’ about.

What’s happening?

Ethiopia. And this time, it’s against themselves. Protests erupted in Ethiopia a few days ago based on an alleged government-backed attempt on the life of Jawar Mohammed, an Ehtiopian-born US citizen and media owner. Reports say about 67 lives have been lost and 213 persons wounded.

According to Mohammed, police officers tried to forcefully remove his personal security detail (basically, the team assigned to protect him). The solidarity street walks by his supporters blew up rather quickly into ethno-religious protests, apparently due to long-repressed tensions between Ethiopia’s many ethnic groups.

Not peace, but a sword

The connections between Mohammed and Abiy are striking: they’re both from the Oromo ethic group, and Mohammed sparked the protests that paved the way for Abiy’s rise to power. It’s not surprising that Abiy’s “if you threaten our peace and security, we will take measures” comment touched a nerve. While Mohammed has urged calm since the protests erupted, he may challenge Abiy in Ethiopia’s 2020 elections.

For now, Abiy has a ton of work to do in sustaining the young democracy, tackling inter-ethnic violence, and convincing critics of his Peace Prize.

|

|

International

How they performed in Q3

During this week, many companies released the report on how they performed from July - September 2019. We look at three companies.

Google: Google reported a worse-than-expected profit. Despite the fact, it brought in a higher revenue of $40.5 billion versus as expected revenue of $40.32 billion – out of which 33.92 billion came from Ad revenue.

This clearly means Google’s costs are higher as it claims to have increased capital expenditures from $5.28 billion in the year-ago quarter to $6.73 billion amongst other costs.

Chief amongst Google’s costs drivers is one of its bets Waymo – a self-driving car project, which lost an astounding $941 million dollars last quarter. Again, that’s nearly a billion dollars in a quarter. In the words of Ben Thompson “Incredibly enough, this wasn’t an aberration! Other Bets has, from 2015 on (when it was broken out), lost an astounding $15.7 billion dollars.

In all these, Google seems to be content with the results as it’s more focused on the long term, having changed its position from being a company that helps you find the right answer to a company that helps you get things done.

Facebook: Facebook got a 'standing ovation' from investors with better-than-expected third-quarter results.

Facebook reported revenue growth of 29% from a year earlier, raking in $17.65 billion in revenue as against an expected $17.37 billion forecast by Refinitiv. While Competition in the online ad market has increased, Facebook is finding more avenues for ad growth at Instagram and through new formats like Stories. Despite going through a very trying period Facebook seems to be doing great, in fact, better than it’s competitors.

Compared to other social networks:

TwitterIt announced weaker earnings than expected after it reported in-app advertisements hadn’t been working properly. There might still be more temporary loss to come after announcing plans to ban political ads altogether this week.

Snap Chat: Last week, Despite the fact that Snap Inc announced it’d brought in more money than expected in its third quarter, investors weren’t too excited.

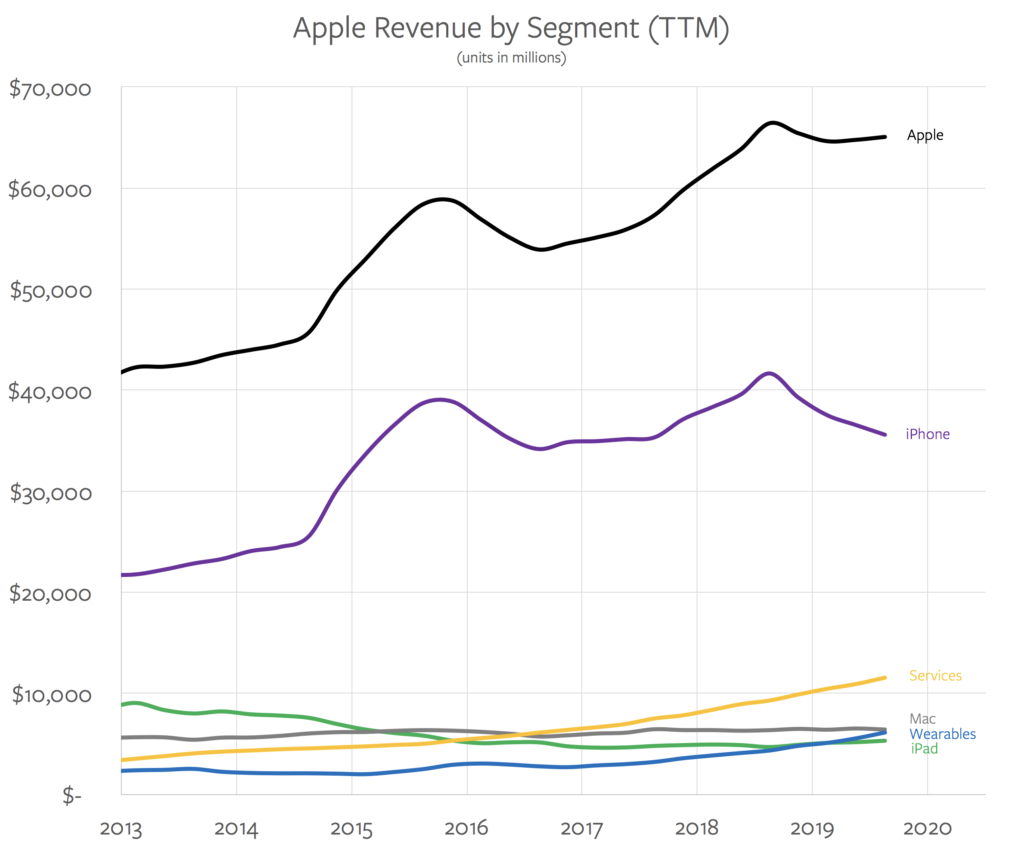

Apple: Apple’s revenue and profit last quarter exceeded investors’ already-high expectations. Raking in a $64 billion as against the $62.99 billion estimate.

This is actually the second quarter in a row that Apple grew revenue overall even as iPhone revenue decreased. While the world seems to be fixated on the decline of iPhone revenue, it’s important to see that Apple is gradually trying to move from solely hardware company to a services companies. The decline in iPhone sales is augmented by an increase in services and wearables sales growth.

|

|

How the mighty has fallen

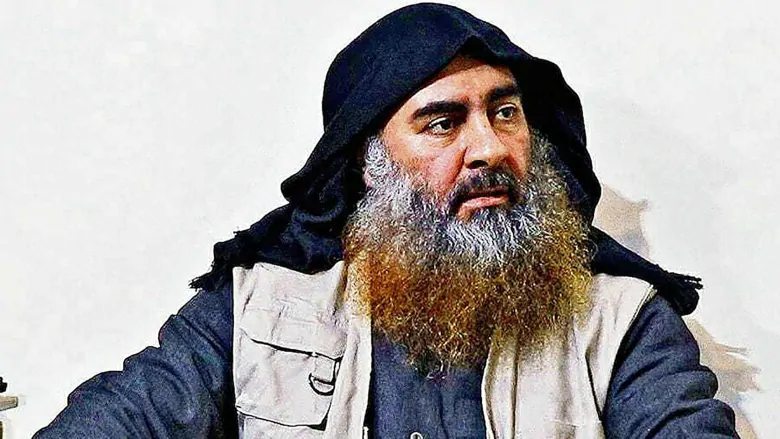

One of the most wanted terrorists in the world was killed during the week.

What is the story?

The Islamic State of Iraq and Syria (ISIS), a Jihadist group that claims religious authority over other Muslims, referring to themselves as a caliphate and was declared terrorist by the United Nations just lost its leader, Abu Bakr Al-Baghdad.

Sounds like good news!

Yes, it is but maybe not, for the group.

In what seemed not to be a heroic death, he blew himself up in a suicide vest when the US troops raided a compound in Northwestern Syria where he was hiding.

Sounds like progress in fighting terrorism

Yea… but don't be too happy with his death because the terrorist group has announced its new leader, Abu Ibrahim al-Hashimi al-Qurashi whose full biography is still unknown.

|

|

|

Thank you for reading this week’s edition. Please share it with a Friend.

Was this forwarded to you? Please Subscribe here.

Got a question about something you don’t understand from this newsletter? Ask us here

|

|

How did you feel about this newsletter?

Hate it Meh Love it

|

|

|

|