March 2019

Russell Robertson, CFP®

Happy Spring! The clocks have all been changed, the equinox is behind us, and summer fast approaches. The Fed apparently decided to get a head start on flip-flop season, however, by going full Left Shark this week.

The audience’s left, not stage left.

As a reminder, this is what the Fed said just three short months ago, back in December (italicized parentheses our own):

“...the labor market has continued to strengthen and...economic activity has been rising at a strong rate. Job gains have been strong...household spending has continued to grow strongly...overall inflation...remain[s] near 2 percent...In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate (i.e., another rate hike)...”

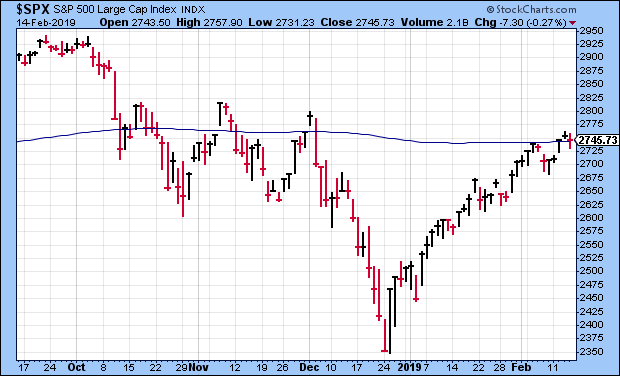

This, of course, was the rate hike that “broke” the market, causing a steep and sudden 20% drop in stock prices. In response, it was widely reported that President Trump discussed firing Fed Chair Powell. Fortunately for markets everywhere, Powell kept the independence of the Fed - nope, scratch that - his job, and a combination of appeasing press conferences about future rate hikes and China trade deal progress along with market technicals led to a similarly fast and furious market rally into January and beyond.

That's more of a "V" than the Mighty Ducks. That graph is currently up around 2850...Buzz Lightyear would be proud.

So, here’s the big-picture setup for the Fed’s performance this week:

A million years ago, back in December 2008, the Fed embarked on a decade of extraordinary (read: never been done before) monetary policy in response to the Great Financial Crisis. This extraordinary monetary policy involved two things: 1) dropping the fed funds rate to 0%, and 2) buying up treasury bonds and mortgage-backed securities as a means of injecting money into the financial system.

Starting (finally!) in 2015, the Fed began to “normalize” it’s policies, given that the bottom of the Great Financial Crisis was old enough for 2nd grade at that point. There was one rate hike in 2015, one in 2016, three in 2017 and four in 2018. Also in late 2017, the Fed started reducing its balance sheet. All those $3.5 trillion (with a “t”) treasuries and mortgage securities it had been buying? Well, it stopped actively buying in 2014 and had just been reinvesting any maturing issues, but in 2017 it started letting the issues mature without reinvesting the money, thereby effectively taking money out of the financial system and reducing the size of their balance sheet back to - wait for it - normal.

The December market-breaking hike is presented in official Fed-speak above, but let us translate for you:

"Things continue to look rosy in the second-longest economic expansion ever. Sorry if previous Fed iterations contributed to blowing a massive stock market bubble, but it’s not our job to save you from stupid investment decisions. As such, we will keep on the path of policy normalization by hiking rates and reducing the size of the balance sheet as we have painstakingly said we would do for the last two years now.”

Sure, it’s not quite 14-14 at the half between the Pats and the Seahawks, but you get the idea. With that as the backdrop, here’s what the Fed delivered on Wednesday:

-

No rate hike. But not just no rate hike! Oh no, they said no rate hikes at all the rest of this year with one more expected next year (yeah, right).

-

In a Monty Python-esque move, the balance sheet reduction is getting phased out, to end completely later this year.

We apologize for upsetting the markets! The balance sheet reductions responsible for such actions will themselves be reduced.

To directly quote the Fed again, this time from Wednesday's prepared statement: “The labor market remains strong but...economic activity has slowed...job gains have been solid...the unemployment rate has remained low...overall inflation has declined...longer-term inflation expectations are little changed.”

And the translation: “We’re sorry! We promise to stop making the markets upset. No more rate hikes and we’re stopping this balance sheet reduction that y’all don’t like...but we’re still doing a good job” (read that last bit real petulantly).

The Fed isn’t the only one to flip-flop recently. The ECB also went from “unwinding” its balance sheet to moar quantitative easing (QE). MOAR!

Draghi? More like Drughi. "QE is a hell of a drug" - Rick James (almost)

Draghi? More like Drughi. "QE is a hell of a drug" - Rick James (almost)

As recently as December, there was a kind of global central bank choreography going on with policy normalization, but that choreography has been officially Left Sharked now. This is your new normal: a 2.5% fed funds rate (until they start cutting again), a $4T balance sheet, sub-2% inflation and sub-2% growth. Yippee skippy.

The immediate response in the markets has been to buy everything, because the Fed has full-on signaled that they will prop up markets as much as possible. Both stocks and bonds ripped higher (for two days anyway...today has been a bit of a rough session for stocks).

But, the philosoraptor asks, if the Fed sees slowing economic growth (and enough slowing to pretty much completely flip-flop in three months), wouldn’t that be bad for stocks? Well yes, yes it would.

Fun fact: the Fed has actually eased (lowered rates) through the last two market crashes. While the markets continued to crash. Remember that yield curve inversion recession indicator we wrote about last month? Well, it flipped today, for the first time since 2007. On average, that means a recession is 311 days out. Mark your calendars for Jan 27, 2020!

The jury is still out on what narrative will coalesce around the Fed actions - an appropriate response flip to economic conditions and an admirable restraint that will enable continued positive (albeit slow) growth, or the first action in response to a slowing economy and forthcoming recessionary flop. Depending on your viewpoint, you’ll either want to position your portfolio for Marshawn Lynch to run it in from the 1 or have Malcolm Butler jump the in-route. And, much like the Fed, you’ll probably do your own fair bit of flip-flopping between the two. Flip-flops roll downhill, as the saying goes. Or something like that.

____________________________

If you’re reading this, it means you either signed up on the website (thank you!), we signed you up, or one of your awesome friends forwarded this over to you and you should go ahead and sign up yourself for a monthly dose of entertainment and thought-provokingness from the world of personal finance. If you're still reading this, we appreciate the support but it's the end of the letter...you can stop now.