Reminder: The Chamber office is open during regular business hours but is limiting walk-in traffic. To ensure timely service please, call ahead and schedule an appointment. The San Dimas Chamber staff can be reached at (909) 592-3818 or by email at info@sandimaschamber.com.

|

|

|

This Week's Chamber Events

|

|

|

Tomorrow! ~ San Dimas Chamber July Coffee Hour

Tues., July 13 from 9:00 a.m.

|

|

|

|

Join us for our first in-person Coffee Hour of the year at NeuroRestorative located at

1136 Puente St., in San Dimas. The event is FREE and open to the public.

|

|

San Dimas Chamber July After Hours Mixer

Thurs., July 15 at 5:00 p.m.

|

|

|

|

Join us this month for our July After Hours Mixer with Host the National Council on Alcoholism and Drug Dependance, Inc. The Mixer will be held at the San Dimas Chamber office located at 246 E. Bonita Ave., in San Dimas. Parking is available at the Chamber as well as across the street at the San Dimas Post Office. The event is FREE and open to the public.

|

|

Upcoming Events - Save the Date!

|

|

|

San Dimas Chamber July Monthly Luncheon

Wed., July 28, 2021

|

|

|

City Birthday

Sat., August 7 from 5 - 9 p.m.

|

|

|

San Dimas Chamber Members Section

|

|

|

The San Dimas Members Section has a new look and location!

Click above to view the latest on our members!

To be included in this section please email info@sandimaschamber.com.

|

|

July Member Spotlight

Coastal Value Publications, Inc. (CVP)

|

|

|

Member Spotlight

1. Describe your Business

Coastal Value Publications, Inc. (CVP) was established in 1993. Twenty-eight years later we pride ourselves in publishing high-quality advertising and marketing direct mail magazines, including the Magazine of Values and the Quarterly Magazine. Our magazines have become household names providing readers with information on local businesses, both new and established, in addition to valuable money-saving purchase incentives and coupons. Our outstanding advertisers make the magazines available to hundreds of thousands of readers, and use them as marketing tools that are not only extremely effective but very affordable. Both our advertisers and readers enjoy our magazines and are very happy with the results.

2. What makes your business unique?

Our magazines have proven to be one of the most cost-effective ways to reach the greatest number of households and businesses in a given zip code area. The FULL-COLOR magazine, which is mailed as a stand-alone piece (nothing is stuffed with it) immediately attracts the interest of the reader.

3. What do customers/clients say about your business?

“An advertising investment definitely worth making. It really works!”

Molly Maid, La Verne, CA (Over 20 Years)

“The Magazine of Values has been a great source of customers for me.”

ABC Smog, La Verne, CA (Over 20 Years)

“We get a great response. It’s very effective advertising.”

La Verne Car Wash, La Verne, CA (Over 20 Years)

“Our Y2K Jewelers has been in the Magazine of Values since 2000 and we are very happy with the customer response.

Y2K Jewelers, San Dimas, CA (Over 20 Years)

4. Why did you join the San Dimas Chamber of Commerce?

We belong to numerous Chambers of Commerce. We believe in supporting the communities where we do business. In addition to mailing over 50,000 magazines every quarter to residents and businesses, we provide chamber offices with numerous copies of our quarterly magazines to make available to residents and business owners who may want to promote their business through advertising in our magazines.

|

|

City of San Dimas and Community News

|

|

|

Foothill Gold Line - Full Street Closure &

June 2021 Project Update and Notices

|

|

|

Funding Relief Options and Resources for Your Business

|

|

|

City of San Dimas

San Dimas Homeless Prevention & Diversion Grant Program

|

|

|

|

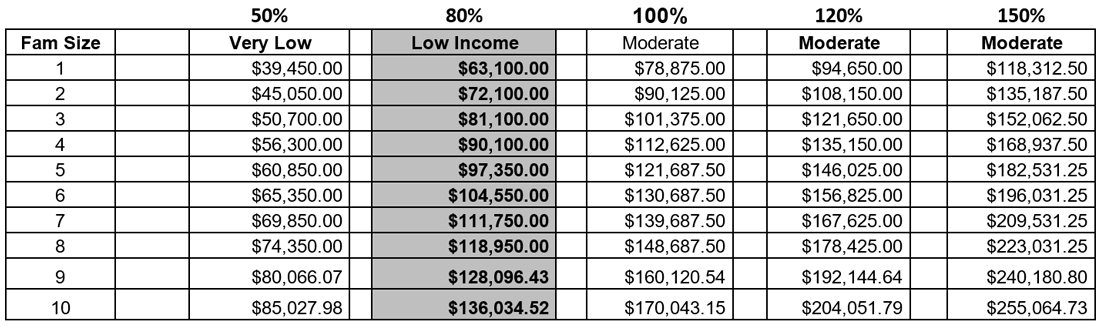

The City of San Dimas in partnership with the San Gabriel Valley Council of Governments, County of Los Angeles and the State of California for the purposes of administering Measure H funds to combat homelessness was awarded funds to help implement elements of our Homeless Plan. Our Homelessness Plan includes action items that focus on homeless prevention for our residents. These funds will offer opportunities to preserve housing affordability and shelter for those that have been impacted by the COVID-19 pandemic. The funds will also assist our residents with their utility payments and grocery cards to meet their basic needs. This emergency financial assistance is designed to provide services to individuals and families at risk of homelessness.

Applicants will be required to provide documentation of their hardship and meet the criteria listed in the application. Applicants must agree to participate in the program by signing a participation and consent form, take part in a problem-solving interview, provide income verification, provide consent to participate in a follow-up interview with City staff or designee. This program is time-limited and can be used for Rental Assistance, Utility payments and Groceries. If funding is fully expended, eligible applicants will be placed on a waitlist and notified if additional funding becomes available.

Participants must live within the City of San Dimas and have a maximum household income at or below 80% of the area median income (AMI) for Los Angeles County. Please contact Ann Garcia at (909) 394-6282 or by email at agarcia@sandimasca.gov with any questions regarding the program.

|

|

City of San Dimas City Council Meeting

|

|

|

Business Resources, COVID-19 Information, & Events

|

|

|

County of Los Angeles Teleconference Schedule

|

|

|

|

Please see the following COVID-19 telebriefing scheduled

for the week of July 12, 2021.

|

|

Supervisor Kathryn Barger's Office

FREE FOOD Drive-Thru Giveaway

|

|

|

SCORE

Upcoming Business Webinars

|

|

|

| Upcoming Webinars To Grow Your Business |

|

Capital: Bootstrapping 101

July 13th | 10:30am-11:30am

ONLINE

All businesses need capital to start operating and to grow.

Capital: Bootstrapping 101 will teach you how to evaluate your funding needs and determine whether a debt or equity strategy is appropriate for your business. Financing options e.g., friends and family, crowd funding, angel investment, venture capital and institutional funds will be discussed. Plus, attendees will gain an understanding of how to craft a fiscal management strategy for growth. |

|

Financial

Projections Made Easy

July 16th | 10am-12pm

ONLINE

Financial Projections Made Easy explains the specific steps to complete the entire forecasting process, focusing on the user-friendly template created by SCORE LA to help determine the financial viability of your business.

This workshop shows how to determine and manage the month-by-month cash flow and provides attendees examples of financial projections tailored to their own companies. Attendees are shown how to calculate the amount of cash they need to run their companies. |

|

Your New Business

Idea Marketing Path

July 19th | 10:30am-12:30pm

ONLINE

Whether your business idea is new to the world or you have an original twist in an existing industry, beginning your business or adding a new division to your existing company will bring unique challenges you may not have faced.

Imagine saving time and saving money while you discover the fastest way to bring that new idea to market. In this seminar, we cover your 3 steps to prove your concept, allowing you to get focused in the right direction. Then you will be given a complete roadmap of 17 simple steps to get you launched. |

|

E-Mail Marketing

Essentials for Business

July 20th | 10am-12pm

ONLINE

Research says that for every $1 spent on E-Mail marketing there is an average $44 return on investment. To generate such positive outcomes, businesses have to reach the right customers with targeted campaigns. If you feel your E-Mail efforts don't yet pay off, this workshop is for you! This class will teach basic and advanced techniques to propel your E-Mail efforts. |

|

|

|

|

|

| Funded in part through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, conclusions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA. |

|

|

|

Small Business Development Center (SBDC)

Upcoming L.A. SBDC Network Webinars

|

|

|

| Ask an Advisor?- Starts, Pivots, Funding & Covid Recovery Q&A |

|

| Hiring Employees in California |

|

About this webinar:

As more Covid-19 restrictions are being relaxed and more businesses fully reopening, employers are hiring again. Join us during this hiring practices webinar to help businesses stay compliant with CA regulations.

You will learn compliance with:

• Required posters & notifications

• Governing agencies (EDD, DFEH, OSHA, DIR)

• Worker classification

• Independent contractor regulations

• Recruiting/Interviewing/compensation do’s and don’ts

• Q&A to follow |

|

DATE: July 13, 2021

TIME: 10:00 AM - 11:00 AM

COST: FREE

LOCATION: Online |

|

| How To Do Social Media for Sales |

|

During this interactive webinar you will discover:

- Who are the main players in the Social Media Game and how to set yourself up to win

- Why are SEO and hashtags so important in Social Media

- How to clarify your message so your target market responds to you with a purchase

- How to be creative to stop the scroll

- How to use Collabs to grow your following faster

- How to create a Community so your followers become loyal customers and brand ambassadors

- The SECRET to Social Media success that will cost you zero dollars

- How to measure your success

- Once you get the sale how to create brand loyalty

|

|

DATE: July 16, 2021

TIME: 10:00 AM - 12:00 PM

COST: FREE

LOCATION: Online |

|

| Bolstering Your Business Through E-Commerce |

|

About this webinar:

For business owners looking to get an overview of the current e-commerce landscape.

- Review of the e-commerce landscape.

- Emerging trends in e-commerce.

- Overview of the different e-commerce platforms.

- Evaluating the marketing channels.

- Discussion of content strategies.

Open to all experiences but most ideal for business owners just getting started with e-commerce and setting up their first store. Come with ideas and inspiration. Feel free to ask questions. |

|

DATE: July 23, 2021

TIME: 10:00 AM - 12:00 PM

COST: FREE

LOCATION: Online |

|

|

|

San Gabriel Valley Economic Partnership

|

|

|

|

|

|

PowerLunch: Certifying as a Women or Minority-Owned Business

July 15, 2021

12:00 pm - 1:00 pm

Certification as a Minority or Women-Owned Business can bring advantages in these sensitive times. Come hear from lawyers at Hahn & Hahn LLP, who can attest first-hand to the advantages and the difficulties of certification.

The PowerLunch 2.0 series is proudly sponsored by Bank of America.

Register Here

Speakers

- Christianne F. Kerns, Managing Partner, Hahn & Hahn LLP

- Laura Farber, Partner, Hahn & Hahn LLP

|

|

|

Statewide Nonprofit Town Hall hosted by the CA

Association of Nonprofits and CA Insurance Commissioner Ricardo Lara

|

|

|

|

COMPASS Training Program is Currently Looking to Partner with Local Businesses!

COMPASS Programs serves young adults between the ages of 18-25 years old who have aged out of the foster care system, also referred to as Transitional Age Youth (TAY).

COMPASS Training Program is a part of COMPASS Programs at David & Margaret.

The COMPASS Training Program takes an individualized approach in supporting the employment and educational goals of young adults. This approach allows for each young adult to gain the skills they need to be self-sustaining individuals while encouraging them to explore their strengths and interests and apply them to employment or higher education.

The COMPASS Training program connects young adults with internships in the local community so they can develop their skills and build their resume to hopefully find permanent employment after their internship has ended. Businesses that host the internships can have up to 3 interns work at their location, and David & Margaret pays the interns for the work they do.

We are currently looking to expand the number of internships we have available in the local community. If you are interested in hosting an internship at your business, but you have questions, please take a look at the PDF which covers FAQs for business owners.

To learn more, or inquire about hosting an internship, please contact the Employment & Education Specialist:

Julie Alamos

AlamosJ@davidandmargaret.org

Cell: (909) 450-4963

Fax: (909) 293-7592

|

|

Department of Public Health

|

|

|

|

The Department of Public Health is looking for businesses and other potential sites that might be interested in partnering to host vaccine clinics. View the flyer above for details.

|

|

COVID-19 Economic Injury Disaster Loan

|

|

|

Eligible small businesses, nonprofits, sole proprietors and independent contractors can still apply for a COVID-19 Economic Injury Disaster Loan. Learn more about EIDL, the Targeted EIDL Advance and Supplemental Targeted Advance.

Learn more

|

|

Jane Walker First Women Grant Program

|

|

|

|

IFundWomen

As part of the First Women campaign, Jane Walker and IFundWomen have teamed up to help create more opportunities for women to achieve their goals. Jane Walker will be funding a total of 30 groundbreaking women-owned businesses through the end of the year. Businesses will be selected across the Entertainment & Film, Music, Sports, STEM, Journalism and Hospitality industries to receive a $10K grant plus a one-year Annual Coaching Membership on IFundWomen. |

|

|

|

TMC Community Capital COVID-19 Recovery Loan Program

|

|

|

|

COVID-19 Recovery Loan Program

TMC Community Capital

The loans are flexible, transparent and are designed to help businesses access the capital and advisory services they need to get through these challenging economic times. Please note, this program is not associated with the federal Paycheck Protection Program (PPP) or any other SBA program. The loans are not forgivable in part or whole. The loans will need to be paid back over a 2- to 5-year term with a fixed annual interest rate. Proceeds can be used for working capital, inventory, marketing, refitting for new social distancing guidelines, operating and emergency maintenance, property taxes, utilities, rent, supplies, and other appropriate business purposes.

|

|

Shuttered Venue Operators Grant

|

|

|

|

Shuttered Venue Operators Grant

SBA

Now Open

The SBA is currently accepting applications for the Shuttered Venue Operators Grant. To submit an application, visit sba.gov/+svogrant.

The Shuttered Venue Operators Grant (SVOG) program was established by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, and amended by the American Rescue Plan Act. The program includes over $16 billion in grants to shuttered venues, to be administered by SBA’s Office of Disaster Assistance. Eligible applicants may qualify for grants equal to 45% of their gross earned revenue, with the maximum amount available for a single grant award of $10 million. $2 billion is reserved for eligible applications with up to 50 full-time employees. |

|

|

|

Los Angeles County Consumer & Business Affairs

|

|

|

Minimum Wage Increases in Unincorporated County of Los Angeles

As Los Angeles County recovers from the effects of the COVID-19 pandemic, workers in unincorporated LA County are getting a much-needed boost. Beginning July 1, 2021, all workers who work two or more hours in the unincorporated areas of Los Angeles County must receive a minimum wage of $15.00 per hour. This applies to both large and small businesses.

Early notice for 2022: In January 2022, LA County’s Chief Executive Officer (CEO) will determine the adjusted rates of the minimum wage based on the Consumer Price Index (CPI). That updated rate will become effective on July 1, 2022.

Click here to determine if you work in the unincorporated areas of the County.

|

|

Webinar: Pathways to Entrepreneurship

Join our partners, SBA and SCORE, for a Pathways to Entrepreneurship webinar on Tuesday, July 20 at 10:00 am.

They will go over all the different ways to go into business (i.e. Start up, Consulting, Buy existing business, Franchising). The presentation includes the pros and cons of each along with what characteristics make a good entrepreneur. They will also discuss financing and using SCORE as a support option for starting any kind of business, with how to open a business during a pandemic.

Learn About Money & Marketing!

Join our partners SCORE and SBA for a Money & Marketing webinar this Thursday at 4:00 pm.

You will learn:

- How to research and budget a marketing campaign

- How to create key goals & objectives

- Write effective copy & use effective imagery

- How to continually optimize your ad spend

|

|

U.S. Small Business Administration

|

|

|

Small Business Tax Credit Programs

Did you know that the American Rescue Plan extends a number of critical tax benefits, particularly the Employee Retention Credit and Paid Leave Credit, to small businesses?

Learn more

|

Federal Coronavirus Resources

State, local, and federal agencies are working together to maintain the safety, security, and health of the American people. Check out coronavirus.gov for updates from the White House's COVID-19 Task Force. Go to cdc.gov for detailed information about COVID-19 from the Centers for Disease Control and Prevention. Visit covid-sb.org, the official federal resource website for U.S. small businesses affected by COVID-19.

Learn more about the federal government's response

|

Virtual Mentoring and Training

Offices around the country may be closed due to the pandemic, but SCORE, Small Business Development Centers, Women’s Business Centers, Veterans Business Outreach Centers and other resource partners are providing free business mentoring and training by phone, email, and video.

Find an SBA resource partner near you

|

|

|

Jewish Free Loan Association JFLA

|

|

|

| Jewish Free Loan Association (JFLA) |

|

Small Business loans up to $36,000 are available, with 2 guarantors.

Eligibility:

· Applicants must be permanent residents of Los Angeles or Ventura county.

· Applicants must have credit scores of 680 or better, demonstrate need, and have the ability to repay the loan.

· Two guarantors with good credit and steady income are required on each loan up to $36,000.

· Applicant must submit required documentation, by email, to JFLA prior to a virtual interview.

· Each applicant presents individual circumstances to be considered by Jewish Free Loan.

Please note that we do not offer Small Business loans to non-profit organizations. |

|

|

|

|

Safer at Work Resources for Business

|

|

|

|

Safer at Work

California Labor and Workforce Development Agency + California Department of Industrial Relations

With the right information and tools, we hope to reach and motivate workers and employers to protect themselves, their workplace, and their community. This site is brought to you by the California Labor and Workforce Development Agency and the California Department of Industrial Relations. It serves as a resource to help prevent the spread of COVID-19 in the workplace and bring awareness and easy access to vital programs, services and information offered by the Department of Industrial Relations. |

|

|

|

Foreclosure Prevention & Mortgage Relief Program

|

|

|

The Foreclosure Prevention & Mortgage Relief Program has been developed in partnership with the LA County Board of Supervisors, NHS Center for Economic Recovery and the Department of Consumer & Business Affairs. This program will provide foreclosure counseling and mortgage relief to L.A. County property owners. If the property owner has experienced financial distress between March 1, 2020 and December 31, 2021 as a result of COVID-19 and the property is located in a community highly impacted by COVID-19, they should consider applying for mortgage relief.

Approved applicants can receive up to $20,000 to help offset mortgage delinquencies. Program Eligibility Includes:

- Residents of LA County

- Residents of LA City are ineligible

- Property must be owner occupied

- Up to 80% Area Median Income for 1-unit property owners

- Up to 150% Area Median Income for 2-4 units property owners

- Counseling with HUD-approved counselor from partner agency required

We will begin accepting applications for this program on April 12, 2021. Have attended our one of our REQUIRED Foreclosure Prevention Workshops? If so, complete your application today.

|

|

University of La Verne SBDC Resource

|

|

|

California Department of Insurance

|

|

|

CA COVID-19 Rent Relief program

|

|

|

|

#California’s critical eviction protections have been extended through September 30, 2021, to help #CA #renters who are unable to pay rent due to the pandemic. Income-eligible #renters & their #landlords impacted by COVID-19 can apply for relief at HousingIsKey.com.

|

|

Los Angeles County Consumer & Business Affairs

Rent Assistance & Financial Navigators Program

|

|

|

Financial Navigators Program Helps Residents Facing Hardship During COVID-19 Pandemic

Are you feeling stressed and overwhelmed about your finances? Get help through our Financial Navigators program. The program can help residents in Los Angeles County who are facing financial hardships due to the COVID-19 pandemic.

Financial Navigators are here to help you prioritize your financial concerns, identify immediate action steps, and make referrals to other social services and resources that may offer long-term assistance. A Navigator can guide you through some of the following concerns:

- Paying for daily expenses

- Supplementing income

- Paying back debt

- Locating food and housing resources

- Finding special services or resources for you and your family

- How to stay well and plan ahead

If you live in L.A. County and are facing financial difficulties, you can get started with a Financial Navigator by completing a short online interest form. You can also call (800) 593-8222 for assistance in completing the form.

Sign-up today to get your free session. Our Navigators are ready to help you!

|

|

Public Hearings on Los Angeles County Redistricting

|

|

|

|

Click below to view information regarding upcoming Public Hearings on Los Angeles County Redistricting. The Public Hearing for the San Gabriel Valley zone will take place on August 11th at 7 pm. There will also be a Countywide Spanish Speaking one on August 7th at 10:00 am. For more information please visit the LA County Redistricting page at:

Click here to for more information

|

|

Free San Dimas Chamber Laminated Business Signs

|

|

|

The San Dimas Chamber is now provided FREE laminated signs for your San Dimas or Chamber Member business locations. Some restrictions apply. Please contact the San Dimas Chamber for details at (909) 592-3818 or email info@sandimaschamber.com.

|

|

Thank you to our sponsors!

|

|

|

|

|

|