February Spotlight

Canadian producer, Calima Energy (ASX:CE1) is bringing the good oil to the ASX with impressive Q4 results.

|

|

- Calima Energy Quarterly results highlight an impressive drill program as it ramps up production of its wells, focussed in southern and central Alberta, Canada

- YTD oil and natural gas sales were A$47.7 million and Adjusted EBITDA1 was approximately A$21.6 million.

- Well capitalised, well priced, and a well forecasted production pipeline, Calima Energy is well placed to be one of the best value, best performing energy stocks on the ASX in 2022

|

Oil prices have surged to seven-year highs as geopolitical tensions in Eastern Europe and the Middle East put the commodity on track for a 17% monthly gain. Brent Crude topped US$91.27 (A$130) per barrel while West Texas Intermediate (WTI) posted a similar gain to hit almost US$88 (A$125) per barrel. These prices mark the highest levels for the oil benchmarks since October 2014 when Brent and WTI hit US$91.70 and US$88.84, respectively.

With Canada now the 4th largest producer in the world and recent news the top 5 Canadian oil stocks have outpaced the broader S&P 500 Energy Index over the past three months, one Canadian oil producer closer to home Calima Energy (ASX: CE1) has announced impressive quarterly results and is already shaping up to be the one to watch in 2022. |

Key announcement highlights

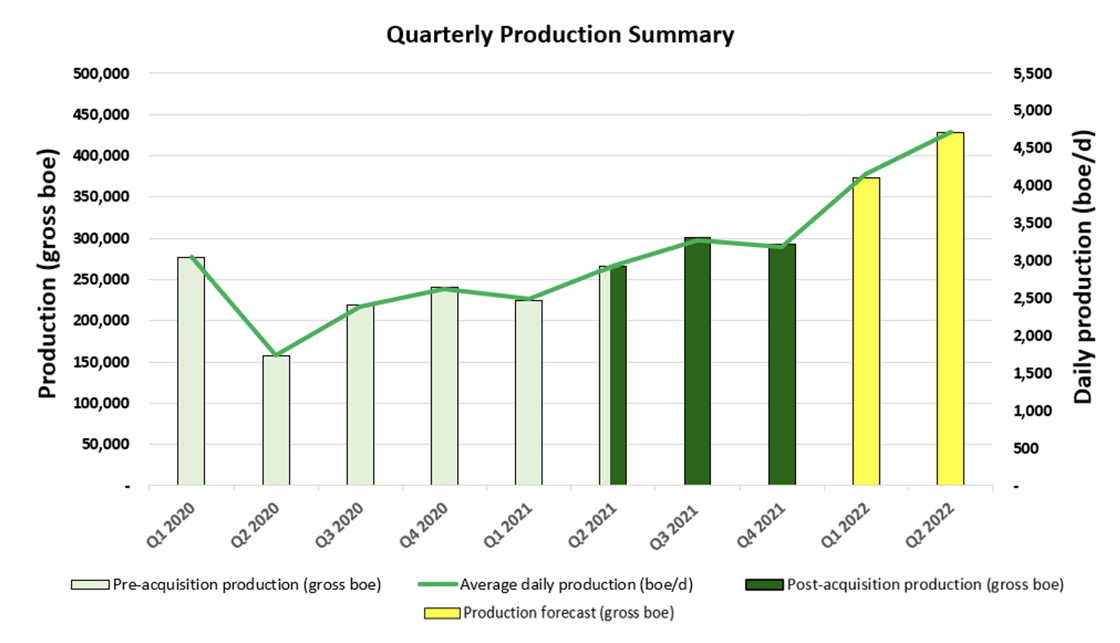

- Production – Production of 294,561 boe (gross) of oil and natural gas, averaging 3,202 boe/d was achieved. YTD, the Company produced 779,570 boe (gross) of oil and natural gas, averaging 3,182 boe/d, a 30% increase compared to the average daily production during the year ended 31 December 2020.

- Quarterly sales and earnings – Oil and natural gas sales were A$19.8 million and the Company delivered Adjusted EBITDA1 of approximately A$9.4 million. YTD oil and natural gas sales were A$47.7 million and Adjusted EBITDA1 was approximately A$21.6 million.

- Energy Prices – In Q4, the benchmark price for oil averaged US$77.19/bbl WTI, C$78.71/bbl WCS and C$4.41/GJ AECO, reflective of improved demand fundamentals for both oil and natural gas in North America in response to recoveries from the COVID-19 pandemic.

|

|

|

|

|

|

Increasing reserves, increasing drilling, increasing results!

- 2022 Forecast – H1 2022 capital investment program of C$19 million for development of the Company’s Brooks core area. The Company’s capital program includes 3 Glauconitic, 3 Sunburst (1 vertical, 2 horizontal), one Sparky (0.5) and the new Pipeline).

For the six months ending 30 June 2022, the Company is targeting:

• Average daily production of 4,000 – 5,000 boe/d; and

• Adjusted EBITDA of C$28-33 million based on current commodity price and production forecasts.

- Strategic infrastructure development – On 31 January 2022, the Company announced the construction of a pipeline connecting the Company’s 02-29 battery in the northern portion of its Brooks, Alberta asset area to its wells, lands, and gathering system in the southern portion of the asset base. The pipeline is expected to be completed and brought on stream during the first quarter of 2022.

- 2021 Capital investments – In Q4 21, the Company commenced flow back operations from three Sparky Formation wells (Leo 1, 2 & 3) in the Thorsby area. Production began in mid-November and oil and gas volumes from the wells continue to increase. As of 25 January 2022, combined production rates from the 3 new wells were ~1,100 boe/d, with corporate production at ~3,800 boe/d.

|

|

The one to watch.

As others are tightening the purse strings and cutting back on infrastructure investments, Calima Energy's comprehensive capital investment program is laser like in its focus on on increasing its reserves and drilling.

Where others merely say, the team at Calima Energy do.

Delivering a steady stream of results over the last 3 months (here). |

|

With a highly experienced and focussed management team based on the ground in Canada, a healthy production pipeline (targeting 4000 barrels a day) one can only ponder, where to from here?

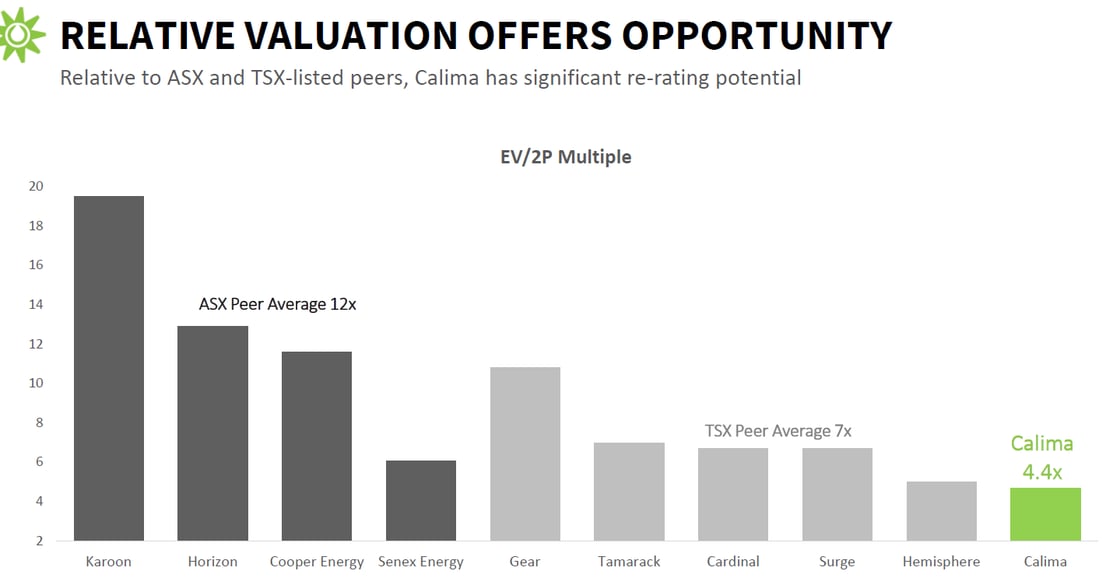

One thing is certain, Calima Energy look set to be one of the best valued-low cost producers on the ASX in 2022. |

|

|

|

|

|

|